What Is Beta In Finance

In the world of finance, understanding risk is crucial to making informed investment decisions. One measure that helps investors gauge the level of risk associated with a particular stock or portfolio is beta. What Is Beta In Finance? Beta is a key concept in finance that quantifies an asset’s volatility relative to the overall market.

By assessing how closely an asset’s price movements align with the broader market, beta provides insights into its potential returns and risks.

This article aims to provide you with a comprehensive understanding of what beta is in finance. We will explore how beta measures volatility, its relationship with market movements, and how to interpret different beta values.

Additionally, we will discuss the significance of beta in investment decision-making and delve into the factors influencing an asset’s beta.

Furthermore, we will discuss how you can use beta as a tool to assess both risk and potential returns when constructing your investment portfolio.

So let’s dive into the world of beta and unlock its secrets to help you make more informed financial decisions.

Key Takeaways

- Beta is a measure of an asset’s volatility relative to the overall market.

- Beta helps investors gauge the level of risk associated with a particular stock or portfolio.

- Beta measures how closely an asset’s price movements align with the broader market.

- Beta can be used to assess risk and potential returns for investments.

Understanding the Basics of Beta

You’ll easily grasp the concept of beta when you imagine a seesaw, with high beta stocks on one end and low beta stocks on the other.

Beta is a measure of a stock’s volatility in relation to the overall market. It helps investors assess the risk associated with a particular stock.

Understanding beta calculation is crucial for evaluating investment opportunities.

A stock with a beta greater than 1 indicates that it tends to move more than the overall market, while a beta less than 1 suggests that it moves less.

Comparing beta and alpha can provide further insights into an investment strategy. Alpha measures the excess return generated by an investment compared to its expected return based on its level of risk (beta).

By comparing these two metrics, investors can determine whether a stock outperforms or underperforms relative to its level of risk.

How Beta Measures Volatility

To understand the volatility of an investment, it’s helpful to examine how beta measures changes in its value. Beta is a measure of market risk that tells you how much an investment’s price moves in relation to the overall market. Here are four key points about how beta measures volatility:

- Market Risk: Beta helps investors assess the level of risk associated with a particular investment by measuring its sensitivity to market movements.

- Calculation Methods: There are different methods for calculating beta, including using historical data or comparing an investment’s returns to a benchmark index.

- Range of Values: Beta can be positive or negative. A positive beta indicates that an investment tends to move in the same direction as the market, while a negative beta means it moves in the opposite direction.

- Interpreting Beta: A high-beta stock is more volatile and has greater potential for gains or losses compared to the overall market, while a low-beta stock is less volatile and offers more stability.

By understanding how beta measures volatility, investors can make informed decisions about their investments and manage their portfolio’s risk exposure effectively.

The Relationship Between Beta and Market Movements

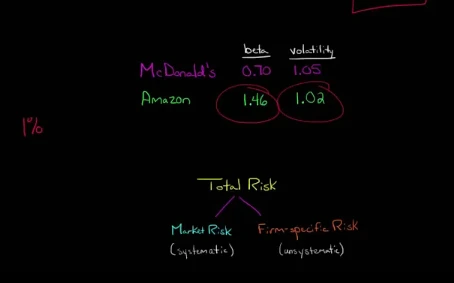

Understand how beta and market movements are connected by examining the relationship between them. Beta is a measure of a stock’s volatility compared to the overall market.

A beta greater than 1 indicates that the stock tends to move more than the market, while a beta less than 1 suggests that the stock is less volatile than the market.

When analyzing beta and stock prices, it’s important to note that high-beta stocks tend to experience larger price swings in response to changes in the market. On the other hand, low-beta stocks are generally more stable and less affected by market movements.

Additionally, beta plays a crucial role in portfolio diversification as investors can reduce risk by including assets with different betas in their portfolios.

Interpreting Beta Values

Interpreting beta values is essential as they help investors analyze stock volatility and its relationship with market movements.

Beta is a measure that indicates how a stock’s price moves in relation to the overall market. A beta value of 1 suggests that the stock tends to move in line with the market, while a beta greater than 1 indicates higher volatility and stronger correlation with market movements. Conversely, a beta less than 1 signifies lower volatility and weaker correlation with the market.

However, it’s important to note that beta analysis has its limitations. It assumes a linear relationship between a stock and the market, disregarding other factors that may influence stock prices. Additionally, beta only considers systematic risk and doesn’t account for company-specific risks or external events.

Therefore, investors should use beta values as one tool among many when making investment decisions.

The Significance of Beta in Investment Decision-making

Explore the importance of beta in your investment decisions and how it can guide you in assessing stock volatility and its relationship with market movements. Beta is a measure that helps investors understand how a stock’s price fluctuates compared to the overall market. By calculating beta, you can gain insights into the potential risks and returns associated with a particular stock. However, it’s important to recognize the limitations of using beta as well. Different methods of calculating beta can yield different results, making it essential to choose an appropriate method based on your investment goals. Additionally, beta only considers market-related risk factors and may not capture all relevant information about a stock’s performance. Therefore, while beta can provide valuable guidance when making investment decisions, it should be used alongside other tools and analysis techniques for a comprehensive evaluation.

Here is a table summarizing some key points about beta calculation methods and limitations:

| Beta Calculation Methods | Limitations of Using Beta |

|---|---|

| Historical Betas | Reliance on past data |

| Fundamental Betas | Subjectivity |

| Regression Betas | Sensitivity to outliers |

| Industry Average Betas | Lack of specificity |

| Forward-Looking Betas | Uncertainty |

Remember that no single metric can guarantee success or predict future performance accurately. Therefore, it is crucial to consider multiple factors when making informed investment decisions.

Factors Influencing Beta

Take a moment to consider the various factors that can sway beta values and impact your investment decisions.

When calculating beta, there are several influencing factors to keep in mind. One key factor is the time period used for data analysis. Different time periods can yield different beta values, so it’s important to choose an appropriate timeframe that accurately reflects market conditions and trends.

Another factor is the choice of index or benchmark used for comparison. The specific index selected can greatly affect the calculated beta value, as different indexes have varying levels of volatility and correlation with individual stocks.

Additionally, changes in a company’s capital structure, such as issuing debt or repurchasing shares, can also impact beta values.

By considering these influencing factors and utilizing proper beta calculation methods, you can make more informed investment decisions based on accurate risk assessments.

Using Beta to Assess Risk and Potential Returns

Consider using beta as a tool to evaluate the level of risk and potential returns for your investments. Beta can provide valuable insights when it comes to portfolio diversification and comparing investments across different industries.

Here are three ways you can utilize beta effectively:

- Assessing risk: Beta measures an investment’s sensitivity to market movements. A high beta indicates higher volatility, while a low beta suggests relative stability. By considering an investment’s beta, you can gauge its potential risk in relation to the overall market.

- Evaluating potential returns: Beta also provides an indication of an investment’s potential returns compared to the market average. Investments with betas above 1 tend to outperform the market during bullish periods, while those below 1 may underperform during bearish periods.

- Comparing across industries: Beta allows for comparisons between investments in different industries by standardizing their volatility against a common benchmark, typically the stock market index.

By using beta as part of your investment analysis, you can make more informed decisions and better manage your portfolio’s risk and return potential.

Frequently Asked Questions

Conclusion

In conclusion, understanding beta in finance is crucial for making informed investment decisions. Beta measures the volatility and relationship between an asset’s returns and market movements. Interpreting beta values can help assess risk and potential returns.

Factors such as industry trends, company-specific factors, and economic conditions influence beta. By using beta to analyze investments, you can make more strategic choices that align with your risk tolerance and financial goals.

Ultimately, mastering beta will make you a financial guru capable of predicting market outcomes with uncanny accuracy.

Related Articles: