What Is Ebitda In Finance

Are you ready to unravel the mysterious acronym that has been making waves in the world of finance? Brace yourself, because we’re about to dive into the depths of what Is ebitda In Finance.

Like a key that unlocks hidden treasures, EBITDA opens up a realm of financial analysis and valuation. But what exactly is EBITDA? Well, it stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

This figure of speech acts as a map leading us to a clearer understanding of a company’s profitability by stripping away various expenses.

In this article, we will explore the definition and calculation of EBITDA, its importance in financial analysis, as well as its limitations. We’ll also delve into how EBITDA is used in valuation and uncover the criticisms surrounding its use.

So get ready to embark on an enlightening journey through the world of finance with our guide to EBITDA!

Key Takeaways

- EBITDA is a financial metric used to evaluate profitability and operational performance.

- EBITDA allows for a clearer view of a company’s core operating performance by excluding non-operating expenses and accounting adjustments.

- EBITDA is useful for comparing companies within the same industry, especially for businesses with high levels of debt or different taxation.

- EBITDA is commonly used in valuation, such as calculating enterprise value and determining deal pricing in mergers and acquisitions.

Definition of EBITDA

EBITDA, a commonly used financial metric, represents a company’s earnings before interest, taxes, depreciation, and amortization. It is an important measure for evaluating profitability and operational performance in the finance world.

By excluding non-operating expenses such as interest and taxes, as well as accounting adjustments like depreciation and amortization, EBITDA provides a clearer view of a company’s core operating performance. This metric allows investors to compare companies within the same industry regardless of their financing or tax strategies.

It is particularly useful when analyzing businesses with high levels of debt or significant differences in taxation. EBITDA helps stakeholders assess a company’s ability to generate cash flow from its operations without being influenced by external factors that are not directly related to its core business activities.

Importance of EBITDA in Financial Analysis

When it comes to evaluating profitability and operational performance, EBITDA plays a crucial role. It allows you to assess a company’s ability to generate profits from its core operations by excluding non-operating expenses.

Additionally, EBITDA can be used as a tool for comparing companies in different industries since it provides an apples-to-apples comparison of their operating performance without the influence of factors such as tax rates and capital structure.

Evaluating Profitability and Operational Performance

Maximizing profitability and operational performance is crucial for achieving long-term success in finance. To evaluate these aspects, financial analysts employ various evaluation methods and financial metrics.

Two important evaluation methods used to assess profitability are Return on Investment (ROI) and Gross Profit Margin (GPM). ROI measures the return generated on an investment relative to its cost, providing insights into how effectively a company utilizes its resources. On the other hand, GPM indicates the percentage of revenue retained after deducting direct costs associated with production or service delivery.

Evaluating operational performance involves analyzing metrics such as EBITDA margin and asset turnover ratio. The EBITDA margin provides a clear picture of a company’s operational efficiency by excluding non-operational income or expenses from the analysis. Meanwhile, the asset turnover ratio measures how efficiently a company uses its assets to generate sales revenue.

By utilizing these evaluation methods and financial metrics, finance professionals can make informed decisions about allocating resources and improving overall profitability and operational performance.

Comparing Companies in Different Industries

Comparing companies in different industries can be challenging due to the unique factors that influence their profitability and operational performance.

When evaluating profitability, it’s important to consider industry-specific metrics such as gross margin, operating margin, and net profit margin. These metrics provide insights into how efficiently a company generates profits from its revenue.

Industry analysis is crucial in identifying the key drivers of profitability for companies within a specific sector. For example, a technology company may have high research and development expenses but also higher profit margins due to its ability to scale its products or services globally.

On the other hand, a retail company may have lower profit margins but benefit from economies of scale through a large customer base.

Thus, when comparing companies across industries, it’s essential to analyze their profitability within the context of their respective sectors.

Calculation of EBITDA

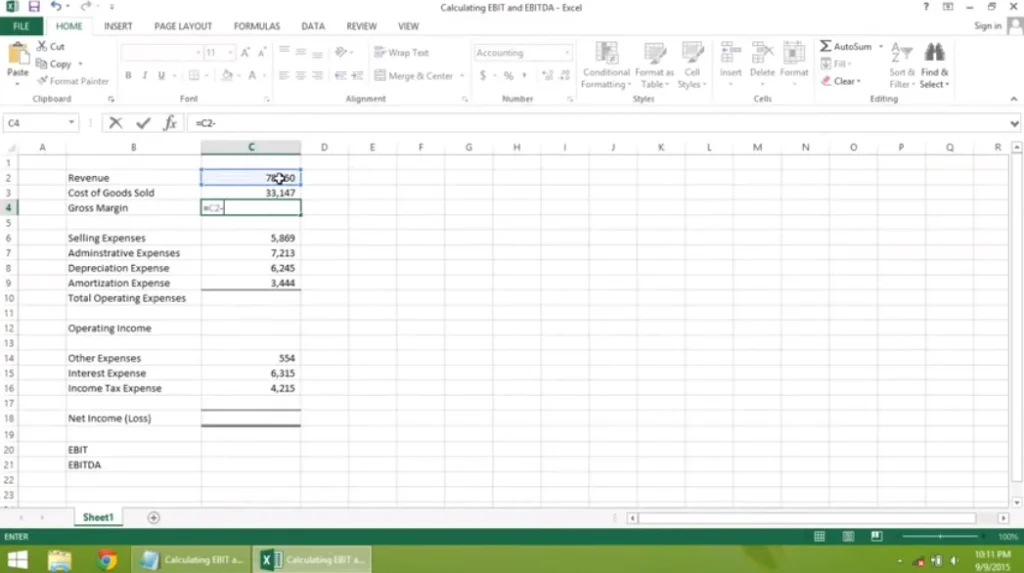

The calculation of EBITDA, also known as earnings before interest, taxes, depreciation, and amortization, is like peeling back the layers of an onion to reveal a company’s true operational profitability.

To calculate EBITDA, you start with a company’s net income and then add back interest expense, tax expense, depreciation expense, and amortization expense. By doing so, you remove the effects of financing decisions (interest), tax obligations (taxes), non-cash expenses (depreciation and amortization), allowing you to focus solely on the core operating performance of the business.

Each component plays a crucial role in determining a company’s overall financial health. Interest expense reflects how much it costs for the company to borrow money. Tax expense represents the amount paid to government authorities. Depreciation captures how assets lose value over time due to wear and tear or obsolescence. And amortization accounts for intangible asset expenses such as patents or trademarks that are spread out over their useful life.

Incorporating these components into your analysis will lead to a more accurate assessment of a company’s operational profitability through EBITDA calculations.

Limitations of EBITDA

Despite its popularity in financial analysis, EBITDA has limitations that restrict its ability to provide a complete picture of a company’s true operational profitability and financial health.

While EBITDA is often used as a proxy for cash flow and is useful in comparing companies within the same industry, it does not take into account important factors such as interest expenses, taxes, and capital expenditures. This can lead to an inflated view of a company’s financial performance.

Additionally, EBITDA does not consider changes in working capital or non-operating income and expenses, which can significantly impact a company’s overall financial position. Furthermore, EBITDA ignores differences in depreciation methods used by different companies, making it difficult to compare companies accurately.

Therefore, when using EBITDA for financial analysis, it is crucial to consider these limitations and supplement the analysis with other measures to obtain a comprehensive understanding of a company’s financial health.

Use of EBITDA in Valuation

In valuing a company, EBITDA is often used as a key metric. One way it’s utilized is in the calculation of enterprise value, which takes into account a company’s market capitalization and debt.

Additionally, EBITDA multiples are commonly employed in mergers and acquisitions to determine the price at which a business can be bought or sold based on its earnings power.

Enterprise Value Calculation

To calculate enterprise value, you’ll need to consider various factors such as the company’s market capitalization, total debt, and cash and cash equivalents.

Market Capitalization represents the total market value of a company’s outstanding shares. It is calculated by multiplying the current share price by the number of outstanding shares.

Total Debt includes both short-term and long-term debts owed by the company. It encompasses loans, bonds, and other forms of borrowed funds.

Cash and Cash Equivalents refer to the amount of cash held by the company or any highly liquid assets that can be easily converted into cash.

By incorporating these factors into your enterprise value calculation, you can gain valuable insights into a company’s financial standing and make informed investment decisions.

EBITDA Multiples in Mergers and Acquisitions

When evaluating mergers and acquisitions, you’ll find that EBITDA multiples play a crucial role in determining the value of the deal. EBITDA multiples in valuation are used to assess a company’s financial performance by measuring its earnings before interest, taxes, depreciation, and amortization (EBITDA) relative to its enterprise value.

This metric provides an indication of how much investors are willing to pay for each dollar of EBITDA generated by the target company. Higher EBITDA multiples indicate a stronger market perception of the target company’s profitability and growth potential.

The impact of EBITDA on deal pricing is significant. Buyers typically use EBITDA multiples as a benchmark when comparing potential acquisition targets and determining their bidding strategies. A higher multiple implies a higher valuation, which can lead to more competitive bidding and potentially drive up the final purchase price. On the other hand, lower multiples may signal concerns about the target company’s financial health or growth prospects, leading to less favorable deal terms for sellers.

Overall, understanding and analyzing EBITDA multiples in mergers and acquisitions is essential for both buyers and sellers to make informed decisions regarding deal pricing and value assessment.

Criticisms and Controversies Surrounding EBITDA

Despite its widespread use in financial analysis, EBITDA has faced significant criticism and controversies due to its exclusion of important expenses, potentially providing an incomplete picture of a company’s financial health. Critics argue that by ignoring crucial costs such as interest payments, taxes, and depreciation, EBITDA can inflate a company’s profitability and create misleading valuations. This has led to concerns that using EBITDA multiples in mergers and acquisitions may lead to overvalued deals or poor investment decisions. Additionally, some argue that relying solely on EBITDA as a measure of financial performance neglects the importance of cash flow and ignores the sustainability of a company’s earnings. To illustrate these criticisms and controversies surrounding EBITDA, consider the following table:

| Criticisms | Controversies |

|---|---|

| Ignores key expenses | Inflated profitability |

| Limited view of financial health | Overvalued deals |

| Neglects cash flow | Sustainability concerns |

By acknowledging these criticisms and controversies surrounding EBITDA, investors can make more informed decisions by considering other metrics alongside it to gain a comprehensive understanding of a company’s financial position.

Frequently Asked Questions

Conclusion

In conclusion, EBITDA is a crucial metric in finance, providing valuable insights into a company’s financial health. By excluding non-operating expenses, it enables investors and analysts to assess the core profitability of a business.

However, it is important to acknowledge its limitations, as it doesn’t consider capital expenditures or interest payments. While EBITDA can be useful for valuation purposes, it has faced criticism for potentially misleading investors by ignoring certain expenses.

Despite these controversies, EBITDA remains an essential tool in financial analysis.

Read More: What Is Leverage In Finance