What Are Derivatives In Finance?

Are you ready to dive into the intricate world of finance and unravel the mystery behind derivatives? Brace yourself, because we’re about to peel back the layers and reveal their secrets.

Like a double-edged sword, derivatives are considered both a blessing and a curse in the financial realm. They can be as volatile as a rollercoaster ride or as stable as a rock-solid investment.

But What Are Derivatives In Finance? In simple terms, they are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, or even interest rates. These complex instruments come in various forms – options, futures, swaps – each with its own unique characteristics.

Their purpose? To manage risk or speculate on future price movements. While they offer potential benefits like hedging against market fluctuations and enhancing portfolio returns, they also bear significant risks if not handled with caution.

The role of derivatives in financial markets cannot be underestimated; they provide liquidity and allow investors to express their views on market trends. However, regulation and oversight are crucial to prevent excessive speculation and maintain stability within the system.

So buckle up and get ready for an enlightening journey into the fascinating world of derivatives in finance!

Key Takeaways

- Derivatives are financial contracts derived from underlying assets and come in various forms.

- They are used for risk management, speculation, hedging, and price discovery.

- Derivatives offer benefits such as hedging against market fluctuations and enhancing portfolio returns.

- However, they carry significant risks if not handled with caution, and proper risk management is crucial when using derivatives.

Definition and Explanation of Derivatives

So, you’re probably wondering, what exactly are derivatives in the world of finance? Well, let me break it down for you.

Derivatives are financial instruments that derive their value from an underlying asset or group of assets. They can be used as hedging strategies to manage risk or as speculative tools for potential profit.

Derivative pricing models are mathematical formulas used to determine the fair value of these instruments. These models take into account various factors such as the current price of the underlying asset, time until expiration, interest rates, and volatility. By analyzing these variables, traders and investors can make informed decisions about buying or selling derivatives.

Understanding derivatives and how they work is crucial in today’s complex financial markets where they play a significant role in managing risk and maximizing returns.

Types of Derivatives

Explore the diverse world of financial instruments that allow you to speculate or hedge against market movements, ranging from options and futures to swaps and forwards. Derivatives are categorized into various types based on their underlying assets and characteristics. Pricing models for derivatives, such as Black-Scholes model for options, help determine the fair value of these instruments.

Options give investors the right but not the obligation to buy or sell an asset at a predetermined price within a specified timeframe. Futures contracts enable participants to buy or sell an asset at a specific price on a future date. Swaps involve exchanging cash flows based on different interest rates or currencies.

Forwards are similar to futures but traded over-the-counter rather than on exchanges. Understanding the types of derivatives and their pricing models is crucial for implementing effective hedging strategies in today’s complex financial markets.

Uses of Derivatives in Finance

One of the key ways derivatives are utilized in the financial industry is to provide investors with a means of managing risk and protecting against potential losses. Derivatives offer various hedging strategies that allow investors to offset risks associated with fluctuations in interest rates, exchange rates, and commodity prices. They also provide speculation opportunities for investors looking to take advantage of market movements and profit from price changes.

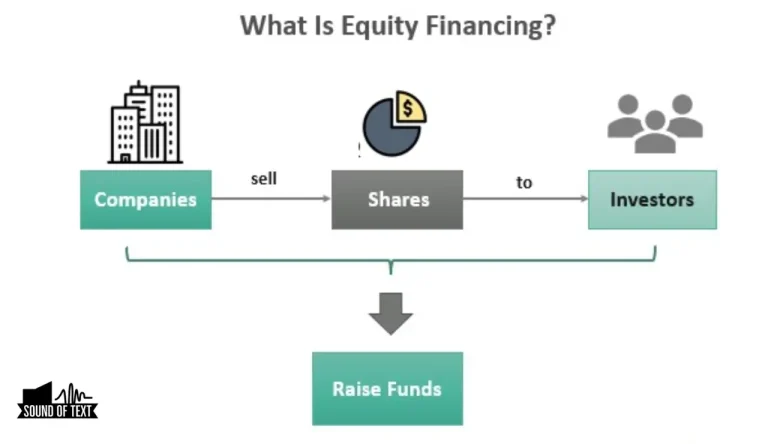

Related Article: What Is Debt Financing

Here are four important uses of derivatives in finance:

- Hedging: Derivatives enable investors to hedge their positions by taking opposite positions in the underlying assets, thereby reducing their exposure to market risks.

- Price Discovery: Derivatives help in determining the fair value of underlying assets by reflecting market expectations and demand-supply dynamics.

- Leverage: Derivatives allow investors to magnify their returns through leverage, as they require only a fraction of the total value of the underlying asset.

- Arbitrage: Derivatives create arbitrage opportunities when there are price discrepancies between related assets or markets, allowing traders to profit from these inefficiencies.

Overall, derivatives play a crucial role in providing risk management tools and investment opportunities for participants in the financial markets.

Benefits of Using Derivatives

A significant advantage of using derivatives is that they offer investors the potential to earn high returns with relatively low initial investment, allowing them to maximize their profits. For example, a study found that options trading can provide an average return of 77% on investment within a year. This makes derivatives particularly attractive for those looking to engage in speculative investments or hedging strategies.

Derivatives allow investors to take positions on the future price movements of underlying assets without actually owning them. This offers flexibility and the ability to profit from both rising and falling markets. By using derivatives, investors can also mitigate risks by creating hedges against potential losses.

Incorporating derivatives into an investment portfolio can enhance overall performance and diversification. The table below highlights some benefits of using derivatives:

| Benefits | Explanation |

|---|---|

| Leverage | Derivatives allow investors to control larger positions with a smaller initial outlay of capital. |

| Liquidity | Derivative markets are highly liquid, providing easy entry and exit points for traders. |

| Risk Management | Derivatives offer various risk management tools, such as options contracts and futures contracts, allowing investors to protect themselves against adverse market movements. |

| Price Discovery | Derivative markets enable efficient price discovery by aggregating information from multiple participants and reflecting it in asset prices. |

Overall, the use of derivatives in finance provides numerous advantages for investors seeking high returns and risk management strategies in their portfolios.

Potential Risks of Derivatives

While derivatives can offer attractive benefits, it’s important to be aware of the potential risks they entail.

One potential risk is counterparty risk, which refers to the possibility that the other party involved in a derivative contract may default on their obligations. This can result in financial losses and disruptions in the market.

Additionally, derivatives are subject to market risk, which arises from changes in underlying assets or market conditions. Fluctuations in interest rates, currency exchange rates, or commodity prices can have a significant impact on the value of derivatives.

It’s crucial for investors to carefully assess and manage these risks when using derivatives as part of their investment strategy. Proper due diligence and risk management practices can help mitigate these potential risks and ensure a more successful outcome when dealing with derivatives.

Role of Derivatives in Financial Markets

Derivatives play a crucial role in financial markets by offering investors the opportunity to diversify their portfolios and potentially increase their returns. They provide a means for investors to manage risk effectively, as they can be used to hedge against adverse market movements.

Here are four ways derivatives impact financial stability:

1) Risk management: Derivatives enable market participants to transfer risk from one party to another, reducing overall systemic risk.

2) Liquidity enhancement: By facilitating trading and increasing market depth, derivatives contribute to improved liquidity in financial markets.

3) Price discovery: Derivatives help determine fair prices for underlying assets through the process of price discovery, enhancing market efficiency.

4) Market efficiency: Derivatives promote efficient allocation of capital by allowing investors to take positions on various asset classes without owning the underlying assets outright.

Overall, derivatives serve as essential tools in risk management and greatly influence financial stability by enhancing liquidity, price discovery, and market efficiency.

Regulation and Oversight of Derivatives

Regulation and oversight of derivatives ensure that market participants adhere to established rules, providing transparency and stability in financial markets.

In the realm of supervision challenges, regulators face the task of monitoring a complex and rapidly evolving landscape. The sheer volume and variety of derivatives instruments make it difficult to keep up with new products and their associated risks.

Additionally, the global nature of derivative markets adds an extra layer of complexity when it comes to coordination amongst different regulatory bodies. Despite these challenges, effective oversight is crucial for maintaining market stability.

By imposing regulations on derivative trading activities, regulators can mitigate the potential for excessive risk-taking and prevent systemic risks from spreading across financial systems. Ultimately, robust regulation and oversight play a vital role in safeguarding the integrity of financial markets and protecting investors from undue harm.

Frequently Asked Questions

Conclusion

So there you have it, dear reader. Derivatives in finance are like the wild west of the financial world. They come in all shapes and sizes, from options to futures to swaps. They can be used for hedging risk or for speculative purposes. While they offer opportunities for big gains, they also come with potential risks that could leave you crying into your spreadsheet.

But fear not! The regulators and overseers of the financial markets are here to keep things in check…or at least try to. So strap on your cowboy boots and venture into the world of derivatives, if you dare!