What Is Debt Financing

What Is Debt Financing? Debt financing is a method of raising capital by borrowing money from individuals, organizations, or financial institutions, with the promise of repayment over time, usually with interest. It allows businesses to access the funds they need without diluting ownership or giving up control.

In this article, we will explore the ins and outs of debt financing – its definition, advantages, disadvantages, types, and how it differs from equity financing. We will also discuss important considerations when choosing debt financing for your business needs.

By understanding the intricacies of debt financing, you can make informed decisions that will propel your business forward while managing risk effectively. So let’s delve into the world of debt financing and unlock its potential for financial growth and success.

Key Takeaways

- Debt financing involves borrowing money with the promise of repayment over time, usually with interest.

- It allows businesses to access funds without diluting ownership or giving up control.

- Debt financing offers potential tax benefits, such as deducting interest payments from taxable income.

- Regular interest payments and the risk of defaulting on debt obligations are key considerations in debt financing.

Definition and Explanation of Debt Financing

Do you know what debt financing is and how it can benefit you?

Debt financing refers to the process of borrowing money from external sources, such as banks or financial institutions, to fund business activities or personal expenses. It involves the repayment of borrowed funds over a specific period, along with interest payments.

One of the major advantages of debt financing is that it allows individuals and businesses to access capital without diluting ownership. This means that they retain full control over their operations and decision-making processes. Additionally, debt financing generally offers lower interest rates compared to equity financing, making it a more cost-effective option in certain situations.

However, it’s important to note that taking on debt also carries risks. The main downside is the obligation to make regular repayments, which can strain cash flow if not managed properly. Furthermore, excessive debt can negatively impact credit ratings and limit future borrowing opportunities.

Therefore, when considering debt versus equity financing options, it’s crucial to carefully weigh the pros and cons based on individual circumstances and financial goals.

Advantages of Debt Financing

When considering the advantages of debt financing, you gain access to capital without diluting ownership. This means that you can secure funding for your business without giving up a portion of your company to outside investors.

Additionally, debt financing offers potential tax benefits, allowing you to deduct interest payments from your taxable income.

Moreover, it provides flexibility in repayment terms, enabling you to negotiate terms that align with your cash flow and financial situation.

Access to Capital without Diluting Ownership

By utilizing debt financing, you can secure the necessary capital without relinquishing ownership of your business. This is a major advantage for entrepreneurs who want to maintain control over their company. Debt financing allows you to borrow money from lenders or financial institutions, which you then repay with interest over a predetermined period of time.

This method of financing provides access to capital while preserving your ownership stake in the business. One key benefit is that it helps you preserve your capital. Instead of using your own funds or selling equity in the business, you can use debt financing to obtain the necessary funds for growth or expansion. This way, you can keep your cash reserves intact and ensure that they are available for other important uses.

Another important factor to consider is the debt to equity ratio. By taking on debt, you are increasing this ratio, which shows how much of your company’s funding comes from debt versus equity. A higher debt to equity ratio indicates that more funding comes from borrowed sources rather than owners’ investments. It’s important to carefully manage this ratio and find the right balance that suits your business needs and risk tolerance.

Overall, accessing capital through debt financing allows entrepreneurs to acquire the necessary funds without diluting ownership. It provides an alternative solution for businesses looking to grow while maintaining control over their operations and decision-making processes.

Potential Tax Benefits

Take advantage of potential tax benefits that can help you save money and maximize your profits. When utilizing debt financing, there are certain tax implications that can work in your favor.

One of the main advantages is the ability to deduct interest payments from your taxable income. This means that you can reduce the amount of taxes you owe, ultimately saving you money.

Additionally, some types of debt financing, such as loans for business expenses or equipment purchases, may qualify for specific tax deductions or credits. These deductions can further lower your overall tax burden and increase your profitability.

It’s important to consult with a tax professional to fully understand the potential tax benefits associated with debt financing and ensure compliance with all relevant regulations.

Flexibility in Repayment Terms

You’ll be amazed by the incredible flexibility in repayment terms that allow you to tailor your payment schedule according to your needs and preferences. When it comes to debt financing, small businesses can greatly benefit from this flexibility.

Here are some key advantages of having flexible repayment terms:

- Adjusting the length of the loan: Whether you need a short-term loan or a long-term one, flexible repayment terms allow you to choose the duration that suits your business’s financial goals.

- Variable interest rates: With flexible repayment terms, you have the option to select variable interest rates that align with market conditions. This can help you take advantage of lower interest rates when they occur.

- Seasonal adjustments: If your business experiences seasonal fluctuations in revenue, flexible repayment terms can accommodate this by allowing for higher payments during peak seasons and lower payments during slower periods.

- Early payment options: Some lenders offer incentives for early payment, such as reduced interest rates or waived fees. Flexible repayment terms make it possible for you to take advantage of these benefits.

The flexibility in repayment terms offered through debt financing provides numerous benefits for small businesses.

Disadvantages of Debt Financing

When considering the disadvantages of debt financing, there are three key points to keep in mind.

First, you’ll have to make regular interest payments on your debt, which can eat into your profits and drain your cash flow.

Second, there’s always a risk of defaulting on your debt obligations if you’re unable to meet the payment terms.

Lastly, taking on too much debt can negatively impact your credit rating, making it more difficult for you to secure future financing or negotiate favorable terms with lenders.

Interest Payments

Imagine the satisfaction you feel when making those interest payments, knowing that they’re bringing you one step closer to achieving your financial goals. However, it’s important to consider the impact of interest payments on your business when using debt financing.

The cost of borrowing can significantly affect your bottom line and overall profitability. Here are a few key points to keep in mind:

- Interest rates: The interest rate on your debt can greatly influence the total amount you end up paying back. Higher interest rates mean more money going towards interest payments.

- Cash flow: Regular interest payments can put a strain on your company’s cash flow. It’s essential to ensure that you have enough funds available to meet these obligations without compromising other essential business operations.

- Long-term commitment: Debt financing often involves long-term commitments, meaning that you’ll be making interest payments for an extended period. This can limit your flexibility and potentially hinder future growth opportunities.

Taking these factors into account will help you make informed decisions about debt financing and its potential impact on your business’s financial health.

Risk of Default

Navigating the world of business comes with inherent risks, and one such risk that entrepreneurs must be mindful of is the potential for defaulting on their financial obligations. Default consequences can be severe and can have long-lasting effects on a company’s reputation and future prospects.

When assessing default risk, lenders consider factors such as the borrower’s credit history, financial stability, and ability to generate consistent cash flow. Defaulting on debt payments can result in penalties, increased interest rates, or even legal action by creditors seeking to recover their funds. It can also make it more difficult for a company to secure future financing or attract investors.

Therefore, it’s crucial for entrepreneurs to carefully evaluate their ability to meet their debt obligations before taking on additional loans or lines of credit.

Impact on Credit Rating

To avoid damaging your credit rating, it’s crucial to be mindful of the potential impact defaulting on financial obligations can have on your company’s reputation and future prospects.

Defaulting on debt payments can have a significant negative impact on your credit score, which is used by lenders to assess your creditworthiness. This can result in higher interest rates or difficulty obtaining future loans or credit lines.

The long-term consequences of a damaged credit rating can extend beyond just borrowing ability. It can affect relationships with suppliers, customers, and business partners who may view a low credit score as a sign of financial instability. Additionally, a poor credit rating can limit opportunities for growth and expansion as it may deter investors from providing funding or make it more expensive to access capital.

Being mindful of the potential consequences and taking proactive steps to fulfill financial commitments will help safeguard your company’s standing and ensure continued growth and success in the marketplace.

Types of Debt Financing

There are various types of debt financing available, each with its own unique features and benefits. Different types of lenders offer different options for obtaining debt financing. Banks, credit unions, and online lenders are some common examples. Each lender has its own requirements and interest rates, so it’s important to research and compare before making a decision.

Debt financing can be beneficial in many ways. It provides businesses with the necessary funds to grow their operations or invest in new projects without diluting ownership. Additionally, interest payments on debt financing may be tax-deductible.

However, there are also drawbacks to consider. Debt financing requires regular payments that can strain cash flow if not managed properly. Moreover, taking on too much debt can negatively impact a company’s credit rating and increase borrowing costs in the future.

Understanding the different types of lenders and weighing the pros and cons is crucial when considering debt financing options for your business.

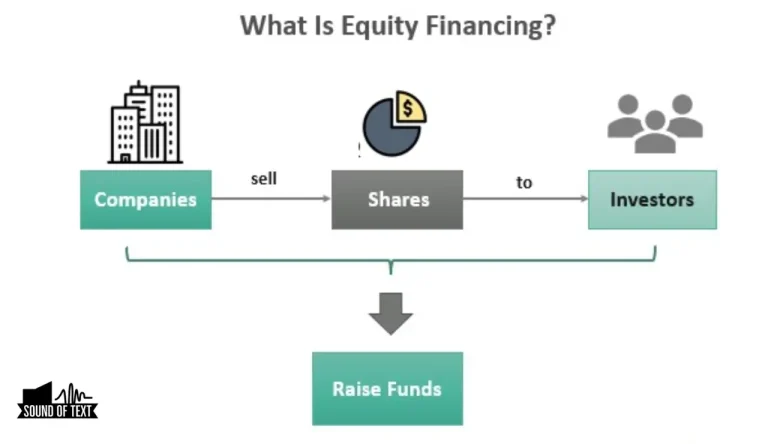

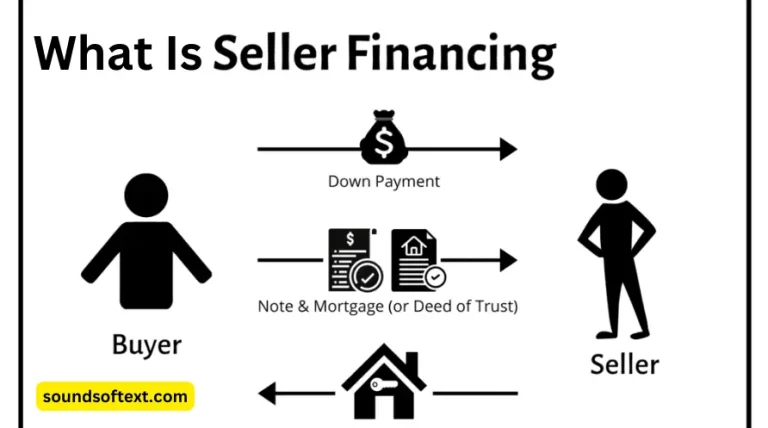

How Debt Financing Differs from Equity Financing

One key distinction between debt financing and equity financing is that with the former, businesses borrow money from lenders, while with the latter, they sell ownership stakes in exchange for capital. Debt financing involves taking on a loan or issuing bonds to raise funds for business operations or investments. On the other hand, equity financing involves selling shares of stock to investors who become partial owners of the company.

| Debt Financing | Equity Financing |

|---|---|

| Borrowed money | Ownership stake |

| Repayment with interest | No repayment required |

| Fixed payments | Variable returns |

| Creditor-lender relationship | Shareholder relationship |

Debt financing offers several advantages such as maintaining control over business decisions and tax benefits due to interest deductions. However, it also comes with risks like repayment obligations and potential negative impacts on credit ratings. In contrast, equity financing allows businesses to avoid repayment obligations but results in dilution of ownership and loss of control over decision-making processes. Additionally, equity investors have a share in profits but also bear potential losses. Overall, understanding these differences is crucial when deciding which financing option best suits a business’s needs and goals.

Considerations for Choosing Debt Financing

Consider the allure of utilizing borrowed funds to strategically enhance your business’s financial position and drive growth. When considering debt financing, there are several factors to consider.

Evaluating the cost of debt financing is crucial as it directly impacts your bottom line. Take into account the interest rates, fees, and repayment terms offered by different lenders.

Assessing your ability to make regular payments is also important. It’s vital to ensure that you can comfortably meet your debt obligations without sacrificing other essential expenses or hindering future growth opportunities.

Additionally, consider the impact on your credit rating and overall financial health when taking on debt. By thoroughly evaluating these factors, you can make an informed decision about whether debt financing is a suitable option for your business’s specific needs and goals.

Debt financing has its pros and cons that must be considered. On one hand, it provides immediate access to capital and allows you to retain full control of your business. However, it also comes with interest payments and the obligation to repay the debt within a certain timeframe.

It’s crucial to weigh these advantages and disadvantages against alternatives such as equity financing or self-funding. Equity financing may involve giving up ownership or control of your business but eliminates the burden of debt repayment. Self-funding, on the other hand, requires using personal savings or reinvesting profits but avoids interest payments altogether.

By carefully considering these alternatives and weighing their pros and cons, you can make a well-informed decision about which financing option is best for your business.

Frequently Asked Questions

Conclusion

In conclusion, debt financing is a powerful tool that can propel your business to new heights. It can provide immediate funds and flexibility, making it the lifeline your company needs. However, tread carefully as too much debt can lead to financial pitfalls and potential bankruptcy. Take into account all the considerations and weigh the pros and cons before making a decision. Debt financing may seem like a double-edged sword, but with proper management, it can be your knight in shining armor, ready to slay any financial dragons that come your way.