What Is Leverage In Finance

Are you ready to dive into the world of finance and explore one of its most powerful tools? Get ready, because we’re about to take a closer look at what is Leverage in finance. It can be your greatest ally, helping you amplify your potential returns and achieve financial success. On the other hand, it can quickly become your worst enemy, exposing you to significant risks and potentially leading to devastating losses.

Leverage is a concept that sits at the intersection of opportunity and danger in the financial realm. In this article, we will break down what leverage really means in finance, discuss its benefits and drawbacks, explore different types of leverage, provide real-world examples to illustrate its application, and highlight crucial factors to consider when using leverage. So buckle up and get ready for an analytical journey through the fascinating world of leveraging in finance.

Key Takeaways

- Leverage in finance is the use of borrowed funds to increase potential returns.

- It allows investors to increase purchasing power and take larger positions in the market.

- While leverage can magnify gains, it also exposes investors to higher risks and losses.

- Risk management strategies are crucial when using leverage in finance.

Definition and Explanation of Leverage

Now, let me break it down for you – leverage in finance is when you use borrowed funds to amplify your potential returns.

It plays a crucial role in investment decision making and has a significant impact on financial stability. By utilizing leverage, investors can increase their purchasing power and take larger positions in the market than they would be able to with just their own capital. This allows them to potentially magnify their gains if the investment performs well. However, it also exposes them to higher risks as losses are also amplified.

Therefore, careful consideration must be given to the amount of leverage used as it can greatly affect the overall risk profile of an investment portfolio. Understanding and managing leverage is essential for achieving optimal returns while maintaining financial stability.

Benefits of Leverage in Finance

Imagine how much more you could achieve by using borrowed funds strategically, tapping into the power of leverage to maximize your potential gains in the world of financial opportunities. Leverage offers several benefits that can significantly impact your financial success.

Advantages of leverage in finance:

- Increased potential returns: By leveraging your investments, you can amplify your gains if the market moves in your favor. This allows you to make larger profits than if you were solely relying on your own capital.

- Diversification: Leverage enables you to spread your investments across multiple assets or markets, reducing the risk associated with having all your eggs in one basket.

- Access to larger investments: With leverage, you have the ability to invest in bigger and potentially more lucrative opportunities that would otherwise be out of reach.

Understanding the importance of leverage is crucial for achieving optimal results in finance. It empowers individuals and businesses alike to capitalize on favorable market conditions and unlock their full potential for growth and profitability.

Drawbacks and Risks of Leverage

One of the drawbacks and risks of using leverage is that it can amplify losses if the market moves against you, potentially leading to significant financial setbacks. This is because when you borrow money to make investments, you’re essentially increasing your exposure to market fluctuations.

If the market goes in your favor, leverage can help maximize your gains. However, if things don’t go as planned, leverage can quickly turn against you. The higher the level of leverage, the greater the risk of losses.

Additionally, leveraging increases your financial obligations as you have to repay both the principal amount borrowed and any interest accrued. This puts additional strain on your finances and reduces your flexibility in managing unexpected events or changes in market conditions.

Therefore, careful consideration and risk management strategies are essential when utilizing leverage in finance.

Types of Leverage in Finance

To fully understand the impact of leverage in your financial strategy, it’s important to explore the different types of leverage available.

Financial leverage refers to using borrowed funds to increase the potential return on investment. It can be a powerful tool in an investment strategy, but it also comes with risks and drawbacks.

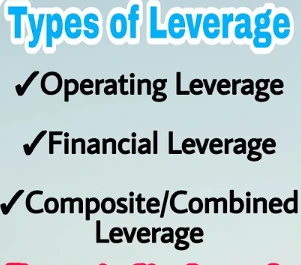

Here are four types of leverage commonly used in finance:

- Operating Leverage: This type of leverage involves using fixed costs to increase profitability when sales volume increases.

- Financial Leverage: It refers to using debt to finance investments, which can amplify returns but also increase the risk.

- Capital Leverage: This type of leverage involves using equity capital or retained earnings to generate additional profits.

- Trading Leverage: It refers to borrowing money from a broker to invest in securities, aiming for higher returns.

Understanding these different types of leverage is crucial as they play a significant role in shaping your overall investment strategy.

Examples of Leverage in Real-World Scenarios

In real-world scenarios, leverage can be seen in action through various examples that showcase the potential benefits and risks of utilizing borrowed funds to amplify returns on investments.

One example is the use of margin trading in the stock market. By borrowing money from a broker, investors can increase their buying power and potentially earn higher profits. However, this also exposes them to higher risks as losses are magnified.

Another example is the use of leverage in real estate investing. By taking out a mortgage to purchase a property, investors can benefit from the appreciation of the property value while only using a portion of their own capital. However, if the market declines or rental income decreases, they may struggle to meet loan payments and face foreclosure.

These examples highlight both the role of leverage in investment and its impact on risk management.

Factors to Consider When Using Leverage

Before diving into the world of leverage, consider the weight it carries and the potential pitfalls that lie beneath its shiny surface. Leverage can be a powerful tool in finance, but it comes with both pros and cons.

Here are three factors to consider when using leverage:

- Risk: Leverage amplifies both gains and losses, so it’s important to carefully assess the risk involved before taking on debt.

- Return on Investment (ROI): While leverage can boost ROI by allowing for greater investment opportunities, it also increases the potential for losses if investments don’t perform as expected.

- Risk Management Strategies: It’s crucial to have robust risk management strategies in place when using leverage, such as setting stop-loss orders or diversifying investments to mitigate potential risks.

By understanding these factors and implementing effective risk management strategies, you can navigate the world of leverage more effectively and potentially reap its benefits while minimizing its downsides.

Thoughts on Leverage in Finance

So, as you conclude your journey through the realm of leverage, it’s crucial to approach it cautiously and with a deep comprehension of its potential effects on your investments. Leverage has a significant impact on financial stability, both positive and negative. When used wisely, it can amplify returns and enhance investment performance. Excessive leverage can lead to substantial losses and even bankruptcy

Successful investors understand the role of leverage in their investment strategies and employ it judiciously based on their risk tolerance and financial goals. They carefully analyze the data to determine the optimal level of leverage that balances potential gains with potential risks. Remember, knowledge is power when it comes to utilizing leverage effectively in finance.

Frequently Asked Questions

Conclusion

So, after diving into the world of leverage in finance, you now understand its definition, benefits, drawbacks, types, and real-world examples.

It’s clear that leverage can be a powerful tool to amplify gains and achieve financial goals. However, it also comes with significant risks that can lead to devastating losses.

With careful consideration of factors like liquidity and risk tolerance, you can navigate the intricate world of leverage. Just remember, while leverage may seem like an enticing shortcut to success, proceed with caution – for sometimes the path to riches is paved with unexpected irony.