What Is Corporate Finance

Are you ready to dive into the intricate world of corporate finance? What Is Corporate Finance? Brace yourself for a journey that will unravel the mysteries behind financial planning, capital allocation, and risk management. Like a skilled conductor orchestrating a symphony, corporate finance plays a vital role in harmonizing the financial activities of an organization. It is the backbone that supports decision-making processes and drives strategic initiatives.

In this article, we will explore the multifaceted realm of corporate finance, dissecting its various components with surgical precision. From financial planning and analysis to budgeting and forecasting, each aspect serves as a building block in constructing a solid financial foundation.

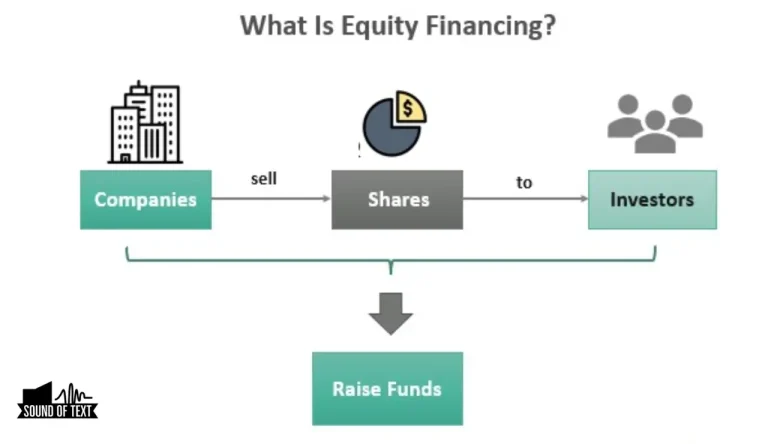

We will delve into topics such as capital structure and financing, understanding how organizations raise funds to fuel their growth ambitions.

But it doesn’t stop there! We will also venture into investment and capital allocation – examining how companies decide where to invest their hard-earned resources for maximum returns. Additionally, we’ll address risk management and hedging strategies to safeguard against potential pitfalls along the way.

So fasten your seatbelt as we embark on this captivating exploration of corporate finance – get ready to unravel its intricacies while uncovering key principles that underpin successful financial decision-making.

Key Takeaways

- Corporate finance is essential for financial planning, capital allocation, and risk management.

- Financial planning and analysis involve creating a roadmap for financial goals and analyzing data for informed decisions.

- Cash flow management is crucial for efficient budgeting and forecasting.

- Risk management and hedging strategies mitigate financial risks and protect against market fluctuations.

Financial Planning and Analysis

Financial planning and analysis involves creating a clear roadmap for your company’s financial goals and analyzing data to make informed strategic decisions. It is a crucial aspect of corporate finance that helps you understand the financial health of your business and enables you to plan for future growth and success.

Through financial modeling, you can develop various scenarios to assess the potential outcomes of different strategies, allowing you to make well-informed decisions. By analyzing historical data, market trends, and industry benchmarks, you gain valuable insights into your company’s performance and identify areas for improvement.

Additionally, financial planning and analysis provide you with the tools to monitor key performance indicators (KPIs) and track progress towards your goals. This allows for proactive decision-making based on real-time information rather than relying on guesswork or intuition.

Financial planning and analysis play a vital role in driving strategic decision making by providing a comprehensive view of your company’s financial landscape.

Budgeting and Forecasting

In the realm of business, effective budgeting and forecasting play a pivotal role in determining future outcomes and ensuring long-term success. Financial projections enable companies to make informed decisions by providing a detailed analysis of expected revenues, expenses, and profitability.

By examining historical data and market trends, businesses can create realistic budgets that allocate resources efficiently. This process involves setting financial goals, identifying potential risks, and monitoring performance against targets.

Cash flow management is an integral part of budgeting and forecasting. It involves tracking the inflow and outflow of cash to ensure sufficient liquidity for daily operations and strategic investments. Through accurate cash flow forecasts, companies can anticipate potential cash shortages or surpluses, allowing them to take proactive measures such as securing additional funding or optimizing working capital.

Budgeting and forecasting are essential tools for corporate finance as they provide a roadmap for achieving financial objectives while also enabling efficient cash flow management.

Capital Structure and Financing

Maximize your company’s potential for growth and profitability by strategically managing your capital structure and financing options.

The capital structure refers to the mix of debt and equity that a company uses to finance its operations. By carefully balancing these two components, you can optimize your company’s financial position and minimize risks.

When it comes to financing options, there are several avenues available to businesses. These include traditional bank loans, issuing bonds or stocks, venture capital funding, and crowdfunding. Each option has its own advantages and disadvantages in terms of cost, flexibility, and control.

To determine the ideal capital structure for your business, it is crucial to consider factors such as industry norms, cash flow projections, risk tolerance, and growth opportunities. Maintaining an appropriate debt-equity ratio is key in ensuring financial stability while also leveraging the benefits of debt financing.

By understanding your financing options and carefully managing your capital structure, you can make informed decisions that support your company’s long-term growth objectives.

Investment and Capital Allocation

Effective investment and capital allocation is crucial for achieving sustainable growth and profitability in your business. Developing a sound investment strategy involves making decisions on how to allocate funds across different projects, assets, and markets. It requires careful analysis of potential risks, returns, and the overall financial health of the company. One key aspect of investment strategy is capital expenditure planning, which involves determining how much money should be allocated towards acquiring or upgrading physical assets such as buildings, equipment, or technology. This decision-making process can be supported by using financial analysis tools like return on investment (ROI) calculations or net present value (NPV) analysis. By optimizing your investment and capital allocation decisions, you can maximize shareholder value and position your business for long-term success.

| Investment Strategy | Capital Expenditure | Financial Analysis Tools |

|---|---|---|

| Diversify investments across various sectors to mitigate risk | Prioritize spending on projects that yield high returns | Use ROI calculations to assess profitability |

| Allocate resources based on market demand and growth potential | Consider future maintenance costs when investing in physical assets | Apply NPV analysis to evaluate long-term viability |

| Continuously monitor market trends and adjust investment strategy accordingly | Evaluate payback period before committing to large capital expenditures | Utilize sensitivity analysis to assess potential outcomes |

(Note: The table provided above is an example of what could be included in this section.)

Risk Management and Hedging

Mitigate potential financial risks and protect your business from market fluctuations by implementing a comprehensive risk management strategy that includes hedging techniques. By utilizing hedging strategies, you can effectively offset any adverse effects of price volatility or currency fluctuations.

Risk assessment plays a vital role in identifying the specific risks your business may face and developing appropriate measures to manage them. To implement an effective risk management strategy, consider the following subcategories:

- Hedging Strategies:

- Utilize derivatives such as options or futures contracts to hedge against price or interest rate movements.

- Diversify your investments across different asset classes to reduce exposure to specific risks.

- Risk Assessment:

- Identify and quantify potential risks associated with market conditions, operational inefficiencies, or regulatory changes.

- Regularly monitor and evaluate the effectiveness of your risk management techniques to make necessary adjustments.

By incorporating these elements into your risk management strategy, you can safeguard your business against unforeseen circumstances and ensure its long-term stability.

Financial Performance Evaluation

Assessing your company’s financial performance allows you to gain valuable insights into its overall health and make informed decisions for future growth. Financial ratio analysis is a critical tool in evaluating your company’s financial performance. By analyzing key ratios such as liquidity, profitability, and solvency, you can identify areas of strength and weakness within your organization.

Benchmarking and industry comparisons are also important when evaluating financial performance. By comparing your company’s ratios to those of other firms in the same industry, you can assess how well you’re performing relative to your competitors. This information can help you identify areas where improvements can be made and set realistic goals for future growth.

Overall, a thorough evaluation of your company’s financial performance through ratio analysis and benchmarking is essential for making informed decisions that’ll drive success and profitability.

Corporate Governance and Ethics

To truly thrive in today’s business landscape, you must prioritize the importance of ethical decision-making and strong corporate governance practices. Corporate governance refers to the system by which organizations are directed and controlled. It encompasses the relationships between a company’s management, board of directors, shareholders, and other stakeholders. Ensuring ethical decision-making is a crucial aspect of corporate governance. However, many challenges exist in this realm. One challenge is the conflict of interest that may arise when individuals prioritize their personal gain over the interests of the organization or its stakeholders. Another challenge is maintaining transparency and accountability within an organization’s operations. By implementing effective corporate governance practices, companies can mitigate these challenges and foster an environment that promotes ethical behavior at all levels.

| Challenges | Ethical Decision Making |

|---|---|

| Conflict of Interest | Prioritizing Stakeholders |

| Transparency | Accountability |

| Compliance |

Frequently Asked Questions

Conclusion

In conclusion, corporate finance is a multifaceted field that encompasses various aspects of financial management within a company. From financial planning and analysis to budgeting and forecasting, every decision made contributes to the overall success and growth of the organization.

Capital structure and financing, investment and capital allocation, risk management and hedging are all vital components that must be carefully considered.

Financial performance evaluation ensures accountability, while corporate governance and ethics ensure responsible decision-making.

Like skilled conductors guiding an orchestra, corporate finance professionals orchestrate the harmonious flow of resources for optimal outcomes.

Related Articles:

Is Finance Consumer Services A Good Career Path

How To Sell A Financed Car Without Paying It Off