Do I Need Insurance For My Vending Machine Business

Are you ready to take the plunge into the world of vending machine business? Do I Need Insurance For My Vending Machine Business?

Before you embark on this exciting journey, let’s talk about something that may not be as thrilling but is equally important – insurance. Just like a well-oiled machine needs regular maintenance, your vending machine business needs proper protection.

Insurance acts as a safety net, shielding you from unexpected risks and potential financial losses. It’s like having an umbrella when it’s pouring rain or a seatbelt when driving on a busy highway.

In this article, we will explore why insurance is essential for your vending machine business, the different types of coverage available, how to evaluate your insurance needs, and tips for choosing the right insurance provider.

So let’s dive in and ensure your vending machine business is fully covered!

Key Takeaways

- Insurance coverage is essential for protecting vending machine businesses against unexpected risks and financial losses.

- Risks in operating a vending machine business include theft, vandalism, equipment malfunction, and legal liabilities.

- Security measures such as installing cameras and choosing secure locations can help deter theft and vandalism.

- Insurance policies for vending machine businesses should include coverage for theft, vandalism, equipment breakdowns, and product liability.

Understanding the Risks of Operating a Vending Machine Business

Operating a vending machine business can be risky, so it’s important to understand the potential hazards involved. Evaluating risk is crucial in order to make informed decisions and protect your investment. By identifying the potential risks, you can take proactive measures to minimize losses.

One of the main risks is theft or vandalism, as vending machines are often left unattended in public areas. Installing security cameras or placing machines in well-lit and secure locations can help deter potential thieves.

Another risk is equipment malfunction, which could result in lost sales and costly repairs. Regular maintenance and inspections can help identify issues before they become major problems.

Additionally, accidents or injuries caused by faulty machines could lead to legal liabilities if you’re not adequately insured. Having insurance coverage specifically designed for your vending machine business can provide financial protection against these potential risks and give you peace of mind as you grow your business.

Types of Insurance Coverage for Vending Machine Businesses

When operating a vending machine business, it’s crucial to have the right insurance coverage in place to protect yourself and your assets.

General liability insurance provides coverage for third-party injuries or property damage that may occur as a result of your vending machines.

Property insurance protects your vending machines and other business property from theft, fire, vandalism, and other covered perils.

Lastly, business interruption insurance can help cover lost income and expenses if your vending machine business is temporarily unable to operate due to a covered event such as a natural disaster or equipment breakdown.

It’s important to carefully consider these types of insurance coverage to mitigate risks and ensure the long-term success of your vending machine business.

General Liability Insurance

Although it may seem unnecessary, having general liability insurance is crucial for safeguarding your vending machine business. Understanding coverage and insurance costs can help you make an informed decision about the type of insurance you need.

General liability insurance provides protection against third-party claims for bodily injury or property damage that may occur on your premises or as a result of your business operations. For example, if a customer slips and falls near your vending machine, general liability insurance would cover their medical expenses and any resulting legal fees.

Additionally, this type of insurance can also protect you from advertising injuries, such as copyright infringement or defamation claims. Investing in general liability insurance ensures that unexpected accidents or incidents won’t cause financial strain on your business and allows you to focus on growing your vending machine venture with peace of mind.

Property Insurance

Property insurance provides coverage for any damage or loss to the physical assets of your vending machine operation, including equipment, inventory, and the building itself. It is essential to have property protection in place for your vending machine business because accidents and unexpected events can happen at any time.

Here are three reasons why property insurance is crucial for your business:

- Equipment Coverage: Property insurance ensures that you’re protected in case your vending machines get damaged due to fire, vandalism, or other covered perils. This coverage helps you replace or repair the machines without significant financial burden.

- Inventory Protection: If your stocked items like snacks and beverages get destroyed or stolen, property insurance will provide compensation for the lost inventory. This coverage allows you to restock and continue operating smoothly.

- Building Safeguard: In case of damage to the building housing your vending machines, such as a fire or natural disaster, property insurance covers repairs or reconstruction expenses. This ensures that your business can quickly recover from such incidents.

Having comprehensive property insurance coverage gives you peace of mind and protects your investment in the vending machine business against unforeseen circumstances.

Business Interruption Insurance

Don’t let unexpected setbacks bring your dreams to a halt – with business interruption insurance, you can ensure that your hard work and dedication are protected from the unforeseen. This type of coverage is designed to provide financial support when your vending machine business experiences a disruption, such as a fire, natural disaster, or equipment failure. It helps cover the loss of income and additional expenses incurred during the interruption period.

To give you a better understanding, here’s an example table:

| Scenario | Coverage Provided |

|---|---|

| Fire damage | Lost income reimbursement |

| Equipment failure | Temporary relocation costs |

| Natural disaster | Rental income replacement |

When it comes to filing an insurance claim for business interruption coverage, it is important to understand the process. Begin by documenting all losses and expenses incurred during the interruption period. Provide necessary documentation such as receipts and financial records. Once submitted, the insurer will review your claim and determine the appropriate compensation based on your policy terms.

Remember, having business interruption insurance can help safeguard your vending machine business against unexpected disruptions and ensure that you stay on track towards achieving your goals.

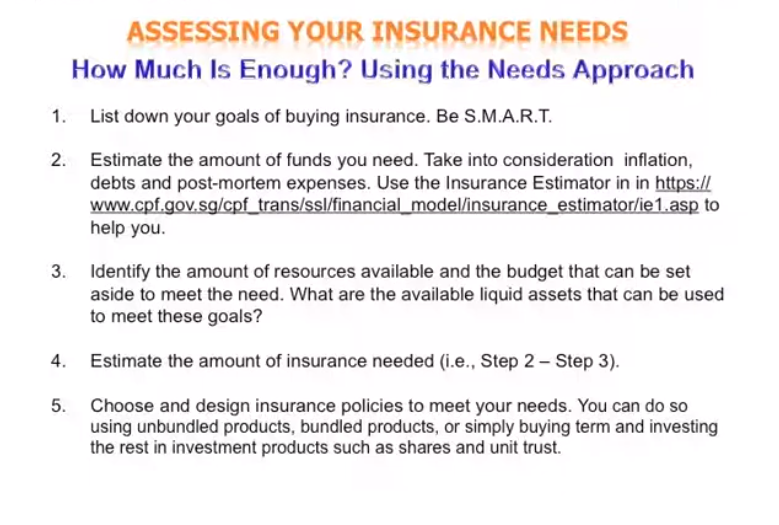

Evaluating Your Insurance Needs

Determining your insurance needs can save you from potential financial disaster in the vending machine business. Evaluating insurance costs and considering various factors when choosing insurance are crucial steps to protect your investment. Here are some key points to consider:

- Assess the value of your vending machines: Determine the total worth of your machines, including any upgrades or customizations, as this will affect the coverage you require.

- Evaluate potential risks: Consider external factors that could damage or disrupt your business, such as vandalism, theft, natural disasters, or equipment malfunctions.

- Research different types of coverage: Explore options like property insurance, liability insurance, and business interruption insurance to ensure comprehensive protection for both physical assets and potential legal claims.

- Compare quotes from multiple insurers: Request quotes from different providers to find the best coverage at a competitive price.

By carefully evaluating your insurance needs and considering these factors, you can make an informed decision that safeguards your vending machine business against unforeseen challenges.

The Benefits of Having Insurance

Imagine the peace of mind you’ll have when unexpected events unfold, and your investment remains protected, thanks to having comprehensive insurance coverage.

As a vending machine business owner, it’s crucial to understand the importance of insurance in your line of work. Accidents happen, and having the right insurance can save you from significant financial losses.

One of the key factors to consider when choosing insurance coverage is liability protection. This will safeguard you against any claims or lawsuits that may arise due to injuries or property damage caused by your machines.

Additionally, considering property and equipment coverage is essential as it protects your vending machines from theft, vandalism, or natural disasters.

Insurance also provides coverage for business interruption due to unforeseen circumstances like equipment breakdowns or supply chain disruptions.

Don’t overlook the benefits of having insurance – they’re invaluable in protecting both your business and its future success.

Choosing the Right Insurance Provider

When choosing the right insurance provider for your vending machine business, it’s crucial to conduct thorough research and compare different companies. By doing so, you can ensure that you’re getting the best coverage at the most competitive rates.

Additionally, take the time to carefully read and understand the policy terms and conditions to avoid any surprises or misunderstandings in the future.

Researching and Comparing Insurance Companies

While exploring various insurance companies, it’s crucial for vending machine business owners to compare coverage options and premiums to ensure they make the best choice.

When comparing insurance premiums, it is important to consider the cost of the policy and what it covers. Some insurance policies may have lower premiums but offer less coverage, while others may have higher premiums but provide more comprehensive coverage.

Understanding insurance deductibles is also essential when evaluating different insurance companies. A deductible is the amount of money that you must pay out of pocket before your insurance coverage kicks in. It’s important to carefully review each company’s deductible policy and determine if it aligns with your budget and needs.

By researching and comparing these factors among different insurance providers, you can make an informed decision that protects your vending machine business effectively.

Reading and Understanding Policy Terms and Conditions

Understanding policy terms and conditions is crucial for making informed decisions about insurance coverage, as a recent study found that 67% of small business owners were not familiar with the specific terms outlined in their policies. To ensure you have a clear understanding of your vending machine business insurance policy, it is essential to carefully read and comprehend the terms and conditions provided by the insurance company. This will enable you to identify any policy exclusions that may limit or exclude coverage for certain events or circumstances. By reviewing your insurance policies thoroughly, you can avoid potential surprises when filing claims and ensure that you have adequate coverage for your vending machine business.

To help illustrate this point, here is an example of a table outlining common policy exclusions in a vending machine business insurance policy:

| Policy Exclusions | Description |

|---|---|

| Theft by employees | Coverage does not extend to theft committed by employees of the insured company. |

| Acts of vandalism | Damage caused intentionally by vandals may not be covered under the policy. |

| Product spoilage | Insurance may not cover losses due to product spoilage or expiration. |

| Equipment breakdown | Repairs or replacements resulting from equipment breakdown might be excluded from coverage. |

| Natural disasters | Damages caused by earthquakes, floods, hurricanes, etc., may be excluded unless specified otherwise in the policy. |

By being aware of these exclusions and understanding the importance of reviewing insurance policies, you can make informed decisions regarding your vending machine business insurance coverage.

Additional Considerations for Vending Machine Business Owners

To protect your vending machine business from unexpected expenses, it’s crucial that you consider additional factors. Aside from reading and understanding the policy terms and conditions of your insurance, there are other important aspects to keep in mind. Here are some additional considerations for vending machine business owners:

- Additional costs: Apart from the insurance premiums, there may be other expenses associated with running your business. These can include maintenance fees, restocking costs, and repair charges for any machines that break down.

- Legal requirements: It’s essential to comply with all legal obligations related to your vending machine business. This includes obtaining necessary permits and licenses, following health and safety regulations, and maintaining proper documentation.

- Location selection: Choosing the right location for your vending machines is crucial. Consider factors such as foot traffic, target market demographics, competition in the area, and accessibility for restocking purposes.

- Security measures: Protecting your machines from theft or vandalism is vital. Implementing security measures like surveillance cameras, alarm systems, or even choosing well-lit areas can help deter potential criminals.

Considering these additional factors will not only help safeguard your vending machine business but also ensure its long-term success.

One common concern for vending machine owners is the coverage provided by their insurance policy. It’s important to understand that having insurance for your vending machine business can protect you from various risks and liabilities.

There are some common misconceptions about insurance for this type of business, such as thinking that general liability insurance is enough to cover all potential losses. However, it’s crucial to have specific vending machine business insurance that includes coverage for theft, vandalism, equipment breakdowns, and product liability.

The cost of insurance can vary depending on several factors, including the number of machines you own, their locations, the value of the products inside them, and your claims history. Working with an experienced insurance agent who specializes in vending machine businesses can help ensure you get the right coverage at a competitive price.

Frequently Asked Questions

Conclusion

So there you have it, the answer to whether or not you need insurance for your vending machine business is a resounding yes.

Just like a sturdy umbrella protects you from the rain, insurance safeguards your business from unforeseen risks and liabilities.

Picture this: Imagine if a customer were to get injured while using one of your machines. Without insurance, you could be left vulnerable to a costly lawsuit that could potentially bankrupt your business.

By investing in the right insurance coverage, you’re essentially shielding yourself from these potential storms and ensuring the longevity of your vending machine venture.